Merchant account comparison of payment gateways show that software application as system (SaaS) enterprise solutions are the best value added. Merchant account service provider that are reviewed for SaaS in merchant account comparison shopping rank higher in client retention and service innovation. If you are looking for a merchant account accept credit cards service, SaaS with electronic financial transaction (EFT) payment gateways partner with a number of verification and data record vendors to provide total enterprise management in transaction accounting. Virtual merchant account services platforms are more than EFT, as well. Innovations in enterprise systems solutions support mean that SaaS eliminates costly and time consuming additional steps within operational processes.

A merchant account service provider EFT system should include partnerships with all major credit cards to ensure 100% of credit card and debit card transactions on purchases (i.e. American Express®, Diner's Club®, Carte Blanch®, Discover, MasterCard®, Visa® and JCB Cards). Step up customer churn with a merchant account accept credit cards model of transaction. Bank guarantees of checks with TeleCheck® Warranty, TeleCheck Electronic Check Acceptance® (ECA®) and VirtualCheck® eCommerce EFT solutions offer immediate verification of funds and same day deposit to merchant accounts.

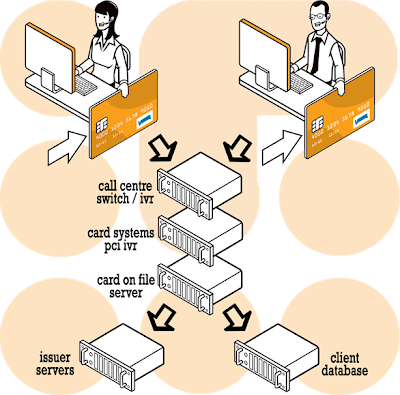

Virtual point-of-sale (POS) capabilities with cloud computing services are the first line of contact with many customers. POS is the source of multiple efficiencies. Cloud computing SaaS creates an entire network of supply chain capabilities. Data collection, management and application in network operations are more effective than ever. Use data to inform inventory record with vendors, or to manage a customer equity marketing campaign. Integration of merchant account services into partnership platforms establishes value at each step in the enterprise management process. Align your business with Big Data. With merchant account service providers business processing is optimized with sector performance.

Compatibility in SaaS interface with existing systems is increasing proficient. Nothing could be easier. From point of installation to the time that a merchant account systems goes live, client services guides the process. Reduce costs in recovery time to operations (RTO) with web based merchant account services provider platform interface. When merchant eCommercesystems fail, merchant account providers assist the RTO process.

Merchants interested in better integration of controller functions in their transaction processes will feel more confident with virtual merchant account services. Fraud protection is a core feature in merchant services agreements. With secured EFT processing, customer transactions are risk free. Review terms and conditions to merchant account service provider third party agreements for rules on sharing and use of proprietary account information and release of data.